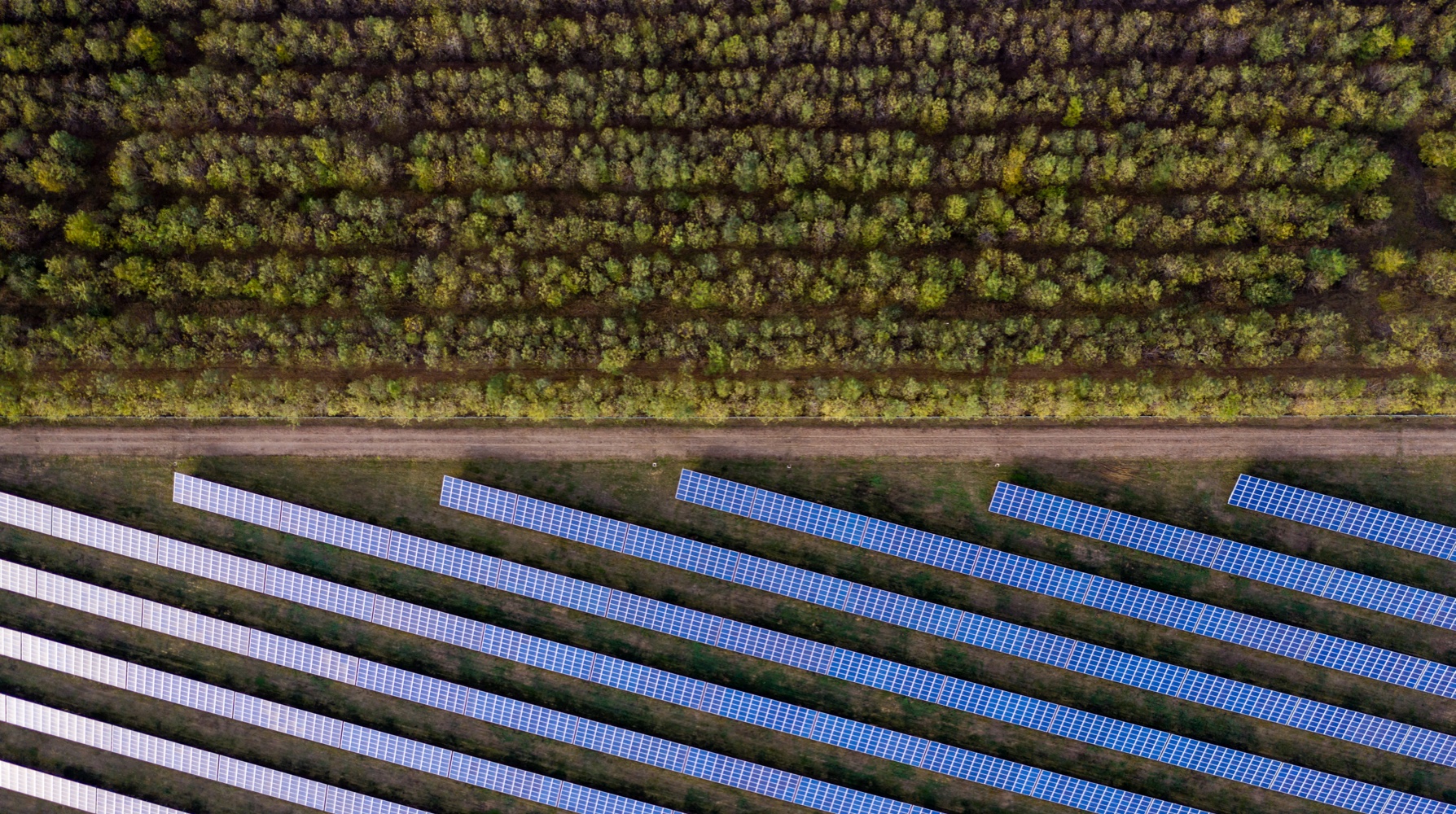

Climate change

We want our influence and actions to accelerate real-world impact when it comes to addressing climate change.

Read more

Companies that thrived in the past may not necessarily guarantee future success. Nowadays, management of ESG factors are essentialfor all companies.

We believe that by recognising and adapting to this shift, we can provide long-term value for our clients and broader stakeholders. We accomplish this by integrating sustainability into our business practices — through our commitment to sustainable investment, responsibly managing our corporate impact, and fostering a positive and thriving corporate culture.

We want our influence and actions to accelerate realworld impact when it comes to addressing climate change. We want to lead the transition to a low-carbon economy through our investment activities and the action that we take within our own operations. Our net-zero ambition plan puts us on a 1.5 degree emissions reduction pathway and will help us reach net-zero across our value chain by 2040.

The vast majority of our GHG emissions exposure comes from the investments we manage on behalf of clients. How we manage the climate risks within our portfolios and influence the transition of the companies in which we invest via external funds to a sustainable future, will be integral to ensuring our continued success. Despite our primary lever of influence and impact being the transition of our clients’ investments, we also believe we should lead by example through our own operations with ambitious targets and actions.

Anthos is an asset manager that manages asset allocations with a great variety of asset classes and invests almost exclusively through external investment funds. This implies that the framework has to be effective in addressing climate goals, risks and opportunities from a fund-of-funds perspective (i.e. a structure that lacks direct influence on the underlying companies invested in).

The great variety of asset classes we invest in implies that methods have to be applicable to a wider range of investment types, while also acknowledging that not every method will be applicable to every portfolio (owing, for example, to data issues, transparency limitations, or to the very nature of the investment).

Anthos’ climate principles

The principles governing our net-zero ambition and implementation plan are:

1

The energy transition presents portfolio opportunities for active investors;

2

The climate integration applies a top-down portfolio perspective, one framework applicable to all, with pragmatic asset class-specific implementation;

3

We pursue a beyond-exclusions strategy because we believe that engagement is a more effective lever of influence than a purely exclusionary approach.

Integration of ESG risks and opportunities into asset allocation, manager selection, engagement and investment for a positive real-world impact are therefore our primary instruments for integrating climate risks into our investment strategy;

4

We encourage positive investments

– for example, in renewable energy and in technologies that enhance energy efficiency and support resilience and adaptation – across all asset classes;

5

We integrate our net-zero climate ambitions in all asset classes and investment strategies to the extent possible

and we continuously look for ways to integrate the net-zero climate ambition when there is no clear cut solution yet.

Bottom up implementation

As part of our RI Scorecard assessment, we label each fund manager as a ‘laggard, novice, professional or leader.’ On their ESG implementation, but also specifically on climate. The decision on whether to invest with a manager is taken not only on the basis of this classification, but also takes account of whether managers are taking steps to improve and work on further integration, and we prefer such managers to those showing no interest in the topic.

We expect leaders to establish fund- and operationallevel carbon reduction targets and to engage with portfolio companies to set targets in line with the SBTi. We believe that membership of and active participation in relevant industry initiatives adds to the quality and knowledge of the manager. We expect a systematic assessment of climate risk exposure as part of investment decision-making and regular portfolio company carbon foot printing, with clear targets and improvement actions being set. Lastly, we expect data collected to be used to manage emissions reductions and reporting back to us to be increasingly transparent.

In addition to selecting the right funds and managers, we use our RI Scorecard to actively engage with funds and managers as well. For each fund and manager, we aim to create a dashboard containing climate-related characteristics and detail the fund’s performance, i.e. the highest carbon-intensive investments in the fund and the exposure of the investments that have set sciencebased targets. This information effectively guides our selection of and engagement with managers. We believe this engagement is crucial and expect this from all our external managers. However, we have also selected an external engagement service provider to engage directly with companies on our behalf in respect of this and other highly relevant ESG themes.

Anthos’ net-zero ambition

Anthos is dedicated to achieving net-zero emissions by 2040, reflecting its commitment to climate responsibility and aligning with global warming limits. Our ambition with setting a net‑zero target is to achieve the Paris Agreement goal to keep global warming well below 1.5oC.29 The pathway for this ambition is shown in Figure 34, which follows an overall 50% reduction target by 2030 (baseline year 2019), and a further 50% reduction by 2040.30

Being cognisant of the fact that, in the best case scenario, the majority of the global economy will follow the 2050 target year stated in the Paris agreement, Anthos most likely has to deal with residual carbon emissions in the portfolios for which we will develop a compensation strategy.

Coverage ambition

We calculated and set our target using reported and estimated emissions. It is notable that we find estimates to be challenging for steering conversations with both managers and clients, so we only measure reported emissions against the targets.31 For this reason, we also target 90% of portfolio assets to have reported emissions available by 2030. Increasing the number of managers and underlying issuers that report on emissions is important for improving and focusing our engagement efforts, as we find engagement on industry estimates not specific enough for our portfolio.

Resilience of the climate strategy: Climate scenario analysis

We believe scenario analysis is the best tool for climate risk assessments. A climate scenario is a forecast used to assess the resilience of our strategy regarding climate-related risks and opportunities. The climate scenario analysis is intended to provide insight into:

- The potential cost of achieving significant reductions in our portfolios’ GHG emissions in various policy, technological and socio-economic scenarios;

- The warming potential of our current portfolios if no additional efforts are made to curb GHG emissions and/or to contribute to technological or other climate solutions;

- Where the biggest opportunities lie regarding capital allocation decisions to reduce our portfolios’ future GHG emissions and/or increase exposure to GHG reductions from technology and innovation.

We have chosen to adopt the MSCI Climate Value-at-Risk (‘Climate VaR’) framework for our scenario analysis as it is the most effectively aligned approach for measuring our contributions to keeping global warming below 1.5⁰C and is also aligned with the risk taxonomy and recommendations of the TCFD.

In other words, Climate VaR shows the cumulative performance likely to be incurred in a chosen scenario due to climate change. While the MSCI model of climate change risks and opportunities extends all the way to 2080, our analysis focuses on the first 15 years. We believe this medium-term carve-out of the MSCI data is sensible because the modelling for the first 15 years is more precise, while policy transition risks and technological opportunities are likely to materialise in the next decade or two, and the duration of an equity security is 15-20 years.

Anthos has identified three policy scenarios as being the most relevant for tracking the climate transition and technological opportunities: the 1.5⁰C scenario, the 2.0⁰C scenario and the 2.0⁰C late-action scenario. Note that Anthos has committed to keeping global warming below 1.5⁰C by 2040. All three scenarios project a peak in emissions in 2020. Both the 1.5⁰C and 2.0⁰C scenarios project a sharp decrease in GHG emissions after 2030, with the 1.5⁰C scenario becoming emission-neutral by 2055 and the 2.0⁰C scenario by 2100. In the 2.0⁰C late action scenario, the transition only starts accelerating to more or less converge with the 1.5⁰C scenario in 2030.

Metrics and targets used to assess and manage climate-related risks and opportunities

GHG emissions (Scope 1, 2 and 3)

Where Anthos has the data available, Anthos measures the Scope 1, 2 and 3 emissions, as shown below. The largest component in our total company emissions comprises Scope 3 emissions (these include the Scope 1 and 2 emissions of the companies in our investment portfolios). For the moment we are not including Scope 3 from the companies in our portfolios. We intend to do this as the data becomes better available. While in the table below we report on economic intensity, we are monitoring and reporting Absolute emissions for all of the portfolios where we have data, directly to our clients.

Total Anthos emissions in 2023 [tCO2e]

| Scope 1 | Scope 2 | Scope 3 (direct)* | Scope 3 (indirect corporates) | Scope 3 (indirect sovereigns) |

| 25.7 | 193.3 | 454.1 | 156,780 | 174,474 |

Figure 32: Carbon metrics ©2023 MSCI ESG Research LLC. Reproduced by permission.

*Scope 3 for Anthos includes business travel, employee commuting but also the carbon footprint of the investments.

Total Scope 1 and 2 GHG emissions in Anthos’ portfolios for 2023

Figure 33: *Weighted Average Carbon Intensity for companies, Floor Area Weighted Average Carbon Intensity for Real Estate Carbon metrics ©2023 MSCI ESG Research LLC. Reproduced by permission.

Anthos emissions since 2019

Anthos net-zero ambition pathway carbon emissions (Ton CO2e/€ m Inv):

Compensation area

GHG Emission Pathway

Anthos Equities Emissions

Benchmark Emissions

Figure 34: Anthos total reported emissions pathway

Source: Anthos Fund & Asset Management. As at 31 December 2023.

Reflects only reported emissions. Carbon metrics ©2023 MSCI ESG Research LLC. Reproduced by permission.

Target setting for our investments

For the total portfolios emissions that are known and reported, we track the path since 2019 and assessed how this fares versus our net-zero ambition pathway. This represents about 30% of our total AuM, reflecting the reported emissions in listed equities and fixed income corporate portfolios. We do not include the estimated emissions in our target and therefore they are not in Figure 34. We report all emissions including the estimated ones in Figure 33.

Equities emissions since 2019

Scope 1&2 (t CO2e/€ m Inv.)

Compensation area

GHG Emission Pathway

Anthos Equities Emissions

Benchmark Emissions

Figure 35: Anthos total reported equities emissions pathway

Source: Anthos Fund & Asset Management. As at 31 December 2023.

Reflects only reported emissions. Carbon metrics ©2023 MSCI ESG Research LLC. Reproduced by permission.

Emissions dropped significantly due to global lockdowns. Subsequently, emissions increased more for the benchmark than for Anthos. This was largely because 40% of companies in our equity portfolios are SBTi companies, much higher than the benchmark. We believe this positively influenced the carbon emissions of our equity portfolios. As shown, we are well below the budget line and on track with our net-zero pathway target.

Fixed income – investment grade

Scope 1&2 (t CO2e/€ m Inv.)

Compensation area

GHG Emission Pathway

Anthos Equities Emissions

Benchmark Emissions

Figure 36: Anthos total reported investment grade bonds emissions pathway

Source: Anthos Fund & Asset Management. As at 31 December 2023.

Reflects only reported emissions. Carbon metrics ©2023 MSCI ESG Research LLC. Reproduced by permission.

The investment grade universe includes many carbon-lite sectors, such as banks, rather than heavy-emitting sectors like industrials, explaining the minimal production decline. Anthos’ emissions outperform the benchmark significantly due to our active selection of managers and funds with net-zero strategies and low-carbon characteristics. As illustrated, we are well below the budget line and on track to meet our net-zero pathway target.

Fixed income – high yield

Scope 1&2 (t CO2e/€ m Inv.)

Compensation area

GHG Emission Pathway

Anthos Equities Emissions

Benchmark Emissions

Figure 37: Anthos total reported high yield bonds emissions pathway

Source: Anthos Fund & Asset Management. As at 31 December 2023.

Reflects only reported emissions. Carbon metrics ©2023 MSCI ESG Research LLC. Reproduced by permission.

Anthos’ high yield portfolios have 75% exposure to US high yield and 25% exposure to Europe, leading to more exposure to traditional, high-emission sectors like industrials and energy compared to the standard benchmark. The Anthos emission line shows a drop during the global Covid lockdowns, followed by a spike as economies recovered. To improve the carbon emissions of the high yield portfolios, our managers decided to sell higher-emitting funds and invest in more sustainable funds that incorporate climate risks into their investment process.

In focus: climate risks & opportunities

There is an important distinction to make between the impact we hope to make on the world and the ESG issues that can pose both risks and opportunities to our investments. This is the principle of double materiality, and we assess both at Anthos.

Below, we outline the key risks and opportunities that we have identified for Anthos, including the potential financial value at risk, or positive financial upside, the time horizon for that risk, the impact level and our strategy for managing such risks and opportunities.

Key risks

Inherent risk:

H

(high)

M

(material)

F

(fair)

L

(low)

Figure 38: Key climate risks for Anthos.

29Please refer to more information on our benchmark relative approach in appendix.

30The baseline is calculated for portfolios as at 31 December 2019 or benchmarks (references).

31The extent to which the targets can be established is very data-dependent: it is subject to data availability. When data availability is an issue for an asset class, it is exempted from the specific target that cannot be measured. However, when the necessary information becomes available, these asset classes will automatically fall under the respective target setting.

Next page

Human rights

How to read this table

The ‘Anthos emissions’ dots represent Anthos’ reported emissions which make up 40% of total assets under management and encompass listed equities and listed corporate debt (European investment grade and global high yield). The ‘budgeting line’ represents the maximum threshold of emissions to enable these portfolios to reach net zero. The ‘compensation area’ from 2040 onwards represents the expectation that we will need to offset any remaining emissions using natural capital solutions. ‘Benchmarks’ represents the total emissions of the respective benchmarks for the equities and listed debt portfolios: MSCI World ACWI, Bloomberg Barclays Euro agg, and Bloomberg Barclays Global high yield, respectively.

How to read this chart

The first column indicates the % of assets under management represented by a particular asset class. We show this to signify the materiality of each portfolio, which goes someway to explaining the levels of carbon emissions.

The middle column expresses the level of data quality for these emissions measurements. This is important to a) assess how reliable the emissions data is b) know if the measurements are good enough to ‘steer’ the portfolio and actively engage. Our data quality emissions measurement is based on PCAF guidance. As the table shows, data quality is high in listed asset classes, and nascent in private markets and alternatives although we are encouraged to see things changing.

The right column shows one of the carbon emissions metrics we look at: we measure and actively use the economic intensity (tCO2e per euro million invested). We also report on absolute emissions in terms of ‘tCO2e’ (metric tons) to our clients.

Good corporate citizenship

| Partnership or alliance | Activity and rationale |

| SFDR working group organised by the Dutch Fund and Asset Management Association | We actively participate in the SFDR expert sessions and initiated an expert group for SFDR implementation for funds of funds. We also contribute via DUFAS in the industry relevant consultations regarding EU policy developments. |

|---|---|

| Impact Frontiers | Over 2022, we participate in a working group with other funds and fund-of-funds to share best practices in integrating the IMP norms in investing, determining investor contribution, sharing knowledge, etc. |

| Global Impact Investing Network (GIIN) | We took part in their annual conference, speaking about investing for systemic change. We are also members of their investor advisory council. |