Human rights

At the heart of our ethos lies a profound commitment to one of our core values: Human Dignity, inspired by the Universal Declaration of Human Rights (UDHR), which asserts that “All human beings are born free and equal in dignity and rights.”

Read more

Our commitment to Human Rights

In 2023, Anthos finalised and published its Human Rights policy, which is shared on our website, addressing the human rights that can be touched by Anthos as an employer, procurer, and the most relevant due to the size of activity, as an investor. Anthos is dedicated to upholding human rights across its operations, supply chain, and investments. We share core values with our parent organisation, COFRA, including a steadfast commitment to Human Dignity. Our employee handbook emphasises the creation of a respectful and inclusive workplace where all individuals can thrive. For example, Anthos has adopted a whistleblowing policy for many years, upgrading it in 2023 to reflect the latest regulatory requirements. What’s more, in 2023 we adopted a new Diversity, Equity, and Inclusion (DEI) policy in alignment with our value of human dignity. Finally, we maintain an active workers’ council to ensure employee representation.

Find more information at our website

Embedding Human Rights in our business

The ultimate responsibility for implementing Anthos’s RI policy, including human rights considerations, lies with our Board. Day-to-day oversight and coordination are managed by our investment, Human Resources, and Operations departments, ensuring comprehensive integration of human rights principles across all aspects of our business. The RI team reports to the head of the investment department and collaborates across departments to help with the further implementation of its policy.

Anthos adheres to stringent Anti-Money Laundering and Know-your-customer (KYC) assessments for business relations, including an adverse media check to identify any involvement in human rights violations. We include questions on human rights during our due diligence on potential investments, monitor the practices of our external managers, and report on the exclusion of Global Compact violaters after a failed engagement.

Human rights in investments

– determining salient issues

Large global portfolios will be exposed to any number of potential or actual human rights issue, and this is why the prioritisation of the salient human right issues is key, where the focus is on prioritising by risk to people and environment rather than the risk to the business, as is the usual understanding of material risk when investing. Also, due diligence in the context of human rights is an ongoing, proactive, reactive, and process-oriented activity. This is slightly different than what investors usually mean when they use the words “due diligence,” often as a one-off process before investment. Taking these differences into account, and using the relevant guidance, we have started on our journey to improve our process.

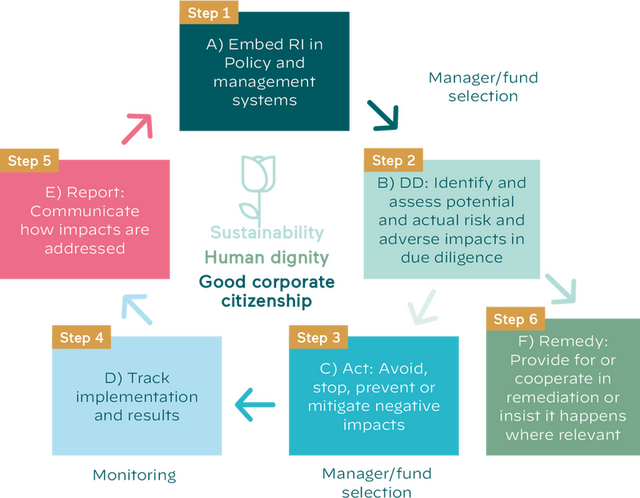

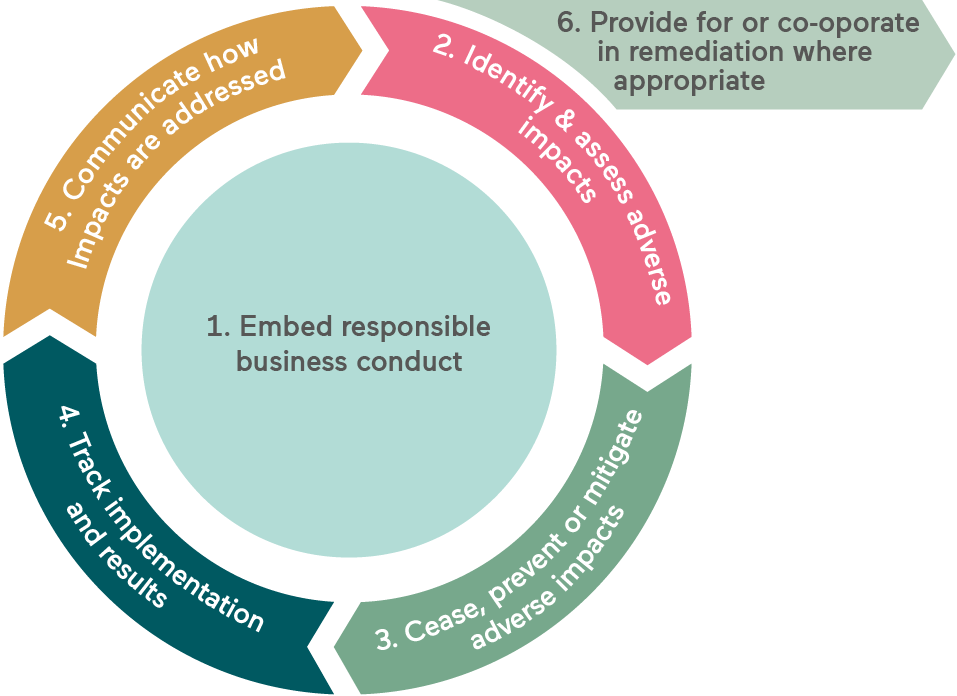

The UNGPs guide how to prioritise Human Rights issues that have severe impact, high likelihood, and irremediability, also known as “salient human rights issues.” And the OECD guidelines provide the six-step approach to human rights due diligence and process. As a fund-of-fund investor, Anthos assesses whether the managers we invest with are considering their potential or actual negative impacts, using UNGPs or other guidelines and including human rights due diligence in their investment process. This is part of our due diligence pre-investment but also engagement during ownership.

In 2022, we partnered with the leading centre of expertise on the UN Guiding Principles on Business and Human Rights, Shift, to develop educational workshops with our colleagues to better understand human rights in the investment context and to take steps toward our commitment to Human Rights. Based on this work, we created a roadmap that is aligned with the OECD (Organisation for Economic Co-operation and Development) Guidelines for MNEs (Multinational Enterprises) on Responsible Business Conduct (RBC) and for Institutional Investors on RBC.27

We pushed forward with this work in 2023, enlisting consultant PwC to develop a salience analysis, which sought to understand the issues most prominent to Anthos and where the results would enable us to create our first Human Rights policy. The end-to-end project took place throughout the year, with many dialogues with underlying fund managers whom we considered leaders in human rights considerations, research undertaken about the relevant guidance, and the development of a two-day salience workshop for the investment department to investigate the salient issues within each asset class (listed equities, fixed income, private real estate, private equity, multi-asset impact, and absolute return strategies).

Anthos RI roadmap and mapping to investment process

Figure 40: Anthos RI roadmap and OECD guiding principles.

Source: Anthos Fund & Asset Management and OECD, 2023.

OECD six guiding principles

In partnership with external experts, Anthos’ portfolio managers practiced how to prioritise and refine their approach to integrating human rights considerations into investment practices. To inform Anthos’ Human Rights policy, outputs from the salience workshop were combined with a top-down focus on the firm’s three values and layered with the interlinking challenges of climate change and inequality.

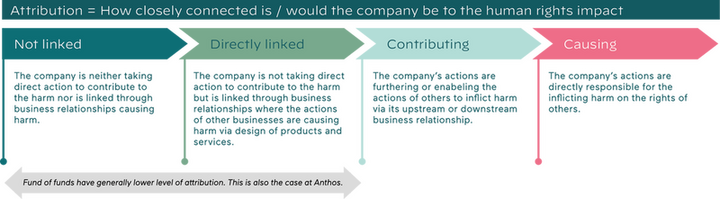

As we hope we’ve demonstrated in this report, Anthos strives to understand the influence we can have most across our entire value chain: As a firm, through our fund-of-funds investment portfolios, and by understanding the insights gleaned from “looking through” our portfolios at the underlying companies/ assets/issuers. From our position as a fund-of-funds investor, we identified that while determining salient issues by sector and country gives good insight into the exposure to these issues, our greatest influence lever is what we can do within our investment portfolios: our focus needs to be towards selecting or engaging with our external managers with a thorough human rights due diligence and monitoring process. In the meantime, we will work on developing deeper insights about the salient issues within each investment portfolio to figure out the topics needed to monitor and engage with specific underlying managers.

Our process to identify Anthos’ salient human rights issues included setting a long and short list, and voting per asset class

To run the salience analysis for each asset class, we took into account the exposure analysis (location and sector) then identified relevant rights and vulnerable groups and used the guidance from the PRI Human rights for investors and the guidance from the Investor Alliance for Human Rights.

During the workshops we worked from the final long list of 15 human rights. We also assessed what kind of involvement Anthos would have with human rights issues in its value chain. We found that for most of the cases this will be "not linked" or "directly linked".

A short recap: how close / far is Anthos away from negative human rights impacts as an investor?

The long list: Here is a comprehensive list of all the human rights issues most relevant to our investment portfolios and underlying assets

Taking into account the exposure to sectors, and geographies we could come up with a list of issues for the current portfolio and the underlying assets. For example, we noted that freedom of association and living wage were some of the salient issues for equities and fixed income listed portfolios, for the real assets right to own property, occupational health and safety, but also data privacy and non-discrimination for private equity. In the end, we concluded that these are good insights.

These insights and the top-down values resulted in our three salient issues on an entity level:

1

Just transition and adaptation

This means transitioning towards environmentally sustainable economies that are fair and inclusive for all by creating decent work opportunities, reducing inequality, and leaving no one behind including workers, communities, indigenous people, people with disabilities, small businesses. It tackles various human rights including freedom of association and collective bargaining. This work fits into our efforts towards net zero and decarbonization of the economy.

Related key policies and guidelines

Key policies and guidelines include the RI policy – net zero by 2040, taking into account human rights and do no significant harm, exclusion policy. We have an annual RI plan and systematically and continuously strive to improve and keep integrating these topics in the investment process. The investment teams have KPIs related to the fulfillment of the RI plan every year.

2

Living wage

Providing a living wage is an essential aspect of decent work, making sure that all workers and their families can live in dignity. It is a complex issue where both governments and businesses must play a role across the supply chains and where there is still work to be done in definitions and monitoring. We note increased action on these critical issues in the acceleration towards achieving the SDGs and will also work to raise awareness to this important ‘enabling right’ that can impact other fundamental human rights including children’s rights and gender equality.

Related key policies and guidelines

We are reviewing relevant collaboration on the topic, and work to include these questions with our managers going forward.

3

Diversity, equity, and inclusion (DEI)

As part of good governance and social issues, is already part of our RI assessment, as we believe that this can improve the social and the human capital of the organisations we work with and the underlying investees in our portfolios.

Related key policies and guidelines

For our business, we implemented a DEI policy in 2023. For investments, we include questions on DEI in our RI Scorecard to assess our managers. At the request of some clients, we also assess how many managers adopt the OECD guidelines.

We are reviewing relevant collaboration on the topic, and work to include these questions towards our managers going forward.

27The OECD Guidelines for Multinational Enterprises on Responsible Business Conduct (OECD Guidelines) are the most comprehensive international standard on RBC. The OECD Guidelines reflect the expectation from governments to businesses on how to act responsibly. They cover all key areas of business responsibility, including human rights, labour rights, environment, bribery, consumer interests, as well as information disclosure, science and technology, competition, and taxation.

Next page

Appendix

How to read this table

The ‘Anthos emissions’ dots represent Anthos’ reported emissions which make up 40% of total assets under management and encompasses listed equities and listed corporate debt (European investment grade and global high yield). The ‘budgeting line’ represents the maximum threshold of emissions to enable these portfolios to reach net-zero. The ‘baseline’ and ‘budgeting point’ labels represent the threshold emissions we calculated for these portfolios to reach net-zero – our carbon budget. The ‘compensation area’ from 2040 onwards represents the expectation that we will need to offset any remaining emissions using natural capital solutions. ‘Benchmarks’ represents the total emissions of the respective benchmarks for the equities and listed debt portfolios: MSCI World ACWI, Bloomberg Barclays Euro agg, and Bloomberg Barclays Global high yield, respectively.

Human dignity

| Partnership or alliance | Activity and rationale |

| United Nations’ Principles for Responsible investment (PRI) | Anthos has been a signatory since 2019. In 2022, we endorsed the human rights engagement initiative ‘Advance’ and joined asset-class specific working groups. |

|---|---|

| SHIFT | We partnered with them throughout 2022 to enhance our human rights approach. |

| Investor Alliance for Human Rights (investorsforhumanrights.org) | We joined this initiative to learn and align with other investors on the same path. We advised them for our human rights statement for example, next to SHIFT. |

Good corporate citizenship

| Partnership or alliance | Activity and rationale |

| SFDR working group organised by the Dutch Fund and Asset Management Association | We actively participate in the SFDR expert sessions and initiated an expert group for SFDR implementation for funds of funds. We also contribute via DUFAS in the industry relevant consultations regarding EU policy developments. |

|---|---|

| Impact Frontiers | Over 2022, we participate in a working group with other funds and fund-of-funds to share best practices in integrating the IMP norms in investing, determining investor contribution, sharing knowledge, etc. |

| Global Impact Investing Network (GIIN) | We took part in their annual conference, speaking about investing for systemic change. We are also members of their investor advisory council. |