Our RI approach

Anthos is a values-based asset manager, striving to invest in line with our core values of sustainability, human dignity, and good corporate citizenship.

Read more

Anthos is a values-based asset manager, striving to invest in line with our core values of sustainability, human dignity, and good corporate citizenship. Our overarching RI objective is to gradually decrease the negative impact and increase the positive impact of our investment portfolios on the world and society.

Our approach is based on a long heritage stretching nearly 100 years of investing responsibly on behalf of the Brenninkmeijer family. In recent years, our approach has resonated with other investors who are seeking holistic investment solutions that align with their values.

In practice, that means we adhere to the principle of double materiality, recognising both the financial impacts of ESG factors on investments and the effects of investments on society and the environment.

Our RI policy integrates these principles, ensuring that our funds meet ESG performance standards and manage sustainability risks. This policy includes firm-level systems and processes, strategy-specific approaches, and further guidelines for sustainability themes for which we are always evolving our approaches. All of our policies are available to read on our website.

A comprehensive RI Framework including various forms of RI

Source: Anthos Fund & Asset Management, as at 31 December 2023. 0,3% is not in scope, referring to currency hedging positions.

Governance of RI at Anthos

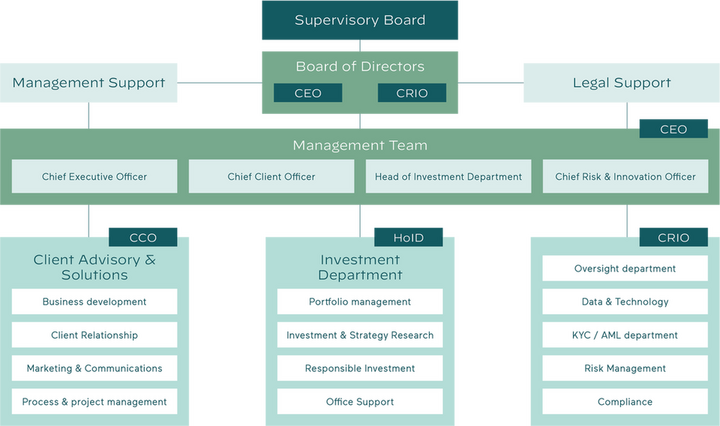

We believe a sound governance structure is key to achieving our RI objectives. Our governance structure ensures that RI is systematically integrated into our organisation and that there is effective ownership by all relevant departments:

- The Board of Directors and the Management Team have formal oversight and accountability for implementing Anthos’ RI policy;

- Our investment teams are responsible for integrating sustainability and ESG considerations into the process for manager selection and investment decision-making;

- Our RI team works closely with the Investment & Strategy Research (ISR) team and the other investment teams by undertaking research and ensuring these teams are provided with input and guidance on best practices for sustainability, ESG integration, and stewardship. In addition, the Head of RI handles driving the RI strategy and for maintaining and evolving our proprietary RI and impact tools in close collaboration with our investment teams.

- The Oversight department supports RI implementation in our system infrastructure and processes.

- The Risk Management and Compliance departments execute monitoring of the execution of RI-related processes and compliance with internal policies as well as applicable laws and regulations16.

- Our Client Advisory & Solutions team collaborates closely with our clients to support and guide them in implementing RI principles.

At Anthos we work through cross-departmental working groups convened around specific issues such as climate, human rights, SFDR and regulatory changes, the measurement of impact, and other relevant topics.

In 2023:

An RI working group was responsible for driving the 2023 RI Roadmap and the progress against Anthos’ RI ambition and targets. This working group, chaired by the Head of RI also included the Head of Investment Department, representatives from the portfolio managers as well as the investment analyst team and the Head of Data & Technology.

Figure 1: Anthos governance structure

Remuneration and incentives for integrating RI

Anthos has implemented a remuneration policy in compliance with the relevant EU regulation17. As part of our incentive scheme and remuneration policy, we have integrated the following sustainability-related measures into the key performance indicators (KPIs) for our investment professionals:

- Be ahead of the curve in implementing RI as part of overall portfolio construction;

- Contribute to the Multi-Asset Impact strategy to generate ideas and assess opportunities;

- Contribute to integrating climate change, ESG, and impact considerations into the Multi-Asset portfolio construction and investment strategy implementation.

Within the investment team specifically, we have integrated KPIs linked to the annual RI roadmap and the RI policy targets, including the management team, portfolio managers, and ISR team. These are designed to incentivise investments in funds that have good policies for implementing ESG issues from both risk and values perspectives. They incentivise researching options for investing in sustainable and impact funds, as well as systematically engaging with external managers to improve the management of these ESG issues in the underlying investments.

Anthos believes that performance metrics should be consistent with the creation of sustainable long-term value and achieving superior performance. They should also support the strategic objectives of the company and should include any relevant ESG considerations.

ESG and sustainability risk management

Anthos has developed an Enterprise Risk Management (ERM) framework that addresses the relevant risks encountered while executing its strategy. This framework also includes the risks faced by clients through the investments managed by Anthos on their behalf. Anthos acknowledges its responsibility for the sound risk management of its clients’ investments, ensuring that all investments are based on a well-considered assessment of risk and return. This assessment includes monitoring ESG and sustainability risks. Climate risks are categorised in our risk taxonomy (see Figure 2) as part of Product Risk – RI & Sustainability risk. The purpose of the risk taxonomy is to support effective and efficient risk management by creating a common risk vocabulary and providing a clear risk classification.

In 2023:

- Key RI risk indicators were included in the first and second-line risk monitoring in the course of 2023 to monitor Anthos’ progress against the RI policy targets. Those were reviewed quarterly by the Business Risk Committee (BRC), which plays an advisory and monitoring role, ensuring the effectiveness of the company’s risk management framework. It includes members such as the Head of Risk, Head of Investment Department, and other key department heads, focusing on various aspects like issue and incident management, investment risk reports, and overseeing the implementation of the Risk management policy. The BRC’s purpose is to provide guidance and oversight on all components of Anthos’ risk management to align with the company’s strategic objectives.

- Our equity and fixed Income portfolios’ greenhouse gas emissions are also included in the first-line monitoring dashboard and monitored against Anthos’ net-zero pathway.

- The climate risks and opportunities – presented on 'Our commitment to Climate and Human Rights' – initially identified by Anthos’ Climate lead and the Head of RI were reviewed by the Chief Risk and Innovation Officer (CRIO), non-financial risk manager and the RI team as part of the Taskforce for Climate Financial Disclosure (TCFD) reporting process.

Figure 2: Anthos risk taxonomy

14Anthos exclusion list is available here, for 2023 reporting (see Underlying assets).

15Article 6 exposure reflects: our absolute return portfolios where clear and accepted sustainability standards are lacking, certain mixed (multi-asset) funds that invest in our own master funds (which are SFDR 8) but without binding elements, or direct investments in three sovereign bonds for which we don’t develop ESG criteria. For more on Athos’ SFDR disclosures, visit our website.

16Anthos’ risk management framework is based on the three lines model, where each line has distinct responsibilities aimed at managing risks and ensuring integrity. First Line: Directly involved in business decisions and processes, managing risk levels while prioritising stakeholder interests. Second Line: Oversees risk management and compliance independently, reporting findings to the Board. Has an escalation line to the Supervisory Board for independence. Third Line: Conducts independent

assurance and challenges to risk management processes. COFRA Group Internal Audit provides oversight, with specific responsibilities outlined in a separate Internal Audit Charter.

17ESMA: European Securities and Markets Authority, MiFID II: Markets in Financial Instruments Directive II, SFDR: Sustainable Finance Disclosure Regulation, AIFMD: Alternative Investment Fund Managers Directive, Wft: Wet op het financieel toezicht (Financial Supervision Act, in the Netherlands), FSA: Financial Services Authority.

Next page

Advancing our strategy

Strategic

Our long-term goals are based on our purpose-driven strategy, which focuses on improving the impact of all assets under management. We hope to achieve these by advocating for public policies that align with our values and by using specific measures (called KPIs) to ensure that we add value in everything we do.

| Ambition | 2022 assessment based on key performance indictors (KPIs) |

| Our net-zero ambition by 2040 | Tentatively on track Comment on progress – Public advocacy, robust emissions measurement methodology, increased emissions coverage, lower emissions than respective benchmarks, net-zero pathways with time-bound ambitions for listed portfolios, and detailed climate policy and handbook. |

|---|---|

| Increase the allocation to investments that ‘benefit stakeholders’ and ‘contribute to solutions’ to 25% by 2025. | Partly on track Comment on progress – each asset class team added new sustainable funds despite the challenging market environment. We hope to accelerate allocations by constantly enhancing our RI roadmap and processes, at the same time we recognise to balance efforts with protecting and growing clients’ capital. |

| Decrease allocation to funds that ‘may or do cause harm’ to no more than 5% by 2025. | Partly on track Comment on progress – Given the challenging market environment in 2022, our asset class teams increased allocations to passive funds which do not score on the IMP methodology. A restructure of our asset base also impacted the overall scores. |

Process

We consider the double materiality of investments at Anthos, with our ESG and impact scorecard the key tool for measurement and engagement.

Increasingly, we are using datasets to help map investments to the well-recognised Sustainable Development Goals (SDGs).

| Ambition | 2022 assessment based on key performance indictors (KPIs) |

| All funds assessed pre-investment with our ESG and impact scorecard | Achieved Comment on progress – ESG and impact topics are considered and documented in our due diligence memo pre-investments. In 2023, we are enhancing our process to use the full scorecard for due diligence. |

|---|---|

| Annually, all relevant funds monitored and/or engaged on improving their ESG integration and impact | Achieved Comment on progress – Of the engagement plans we conducted in 2022, 100% were monitored/engaged with for all asset classes save for private equity which saw 98% of funds monitored/engaged with. |

| Measure impact alignment to the SDGs across all asset classes and report impact performance by 2025 | On track Comment on progress – In 2022, we joined specialised SDG-aligned data platform, the SDI AOP, and began to measure equities and fixed income vs SDGs. We hope to roll this out to all asset classes in the coming years. |

Basics

Exclusions of undesirable companies or industries that don’t align with our values, continuous learning for our staff, and achieving the highest score in ESG integration from the Principles for Responsible Investment (PRI) fall into this category. These are the basics for creating a solid approach to implementing our values.

| Ambition | 2022 assessment based on key performance indictors (KPIs) |

| No more than 5% exposure to issuers on Anthos' exclusions list | Achieved Comment on progress – Well below the target. |

|---|---|

| 100% staff trained on responsible investment topics annually | Achieved Comment on progress – 100% staff trained on climate, whilst significant proportion trained on human rights. |

| PRI assessment | Delayed Comment on progress – A good way to assess the effectiveness of an asset manager's responsible investment practices, is the evaluation through the PRI assessment. However, the assessment score will not be available for 2022 as the PRI has temporarily suspended reporting. We are eagerly anticipating the next assessment in 2023, as we use it to identify any gaps in our current process and to further improve our responsible investment practices. |

How to read this chart

We introduced our ESG scorecard in 2020. 75% is an estimated number of the managers we mapped, due to there not being a formal procedure in place to track this until 2021.

The remaining assets were either not scored, or not applicable to scoring.

How to read this chart

The remaining 4% of assets in 2022 are not applicable to scoring,

which includes legacy assets and direct bonds.

How to read this chart

We introduced official engagement plans for each asset class team in 2022, which relate to the most material managers within the portfolios, and successfully engaged with the majority of them across asset classes. Previous engagements did take place, but did not follow a formal structure and were not tracked so we have left them out.